Collect First, Invest Second

Buyers who view collectible coins chiefly as potential investments are denying themselves some of the greatest benefits of coin collecting, while ironically undermining their primary objective of increased financial returns. Their “portfolios” are more likely go up in flames because they failed to become informed collectors before donning the investor cap.

The most successful coin investors adopt a “Collect First, Invest Second” mentality. They may take years to first educate themselves as collectors about coin grading, historical legacies, rare dates in high demand, die varieties, coin storage, coin striking techniques, numismatic subtleties, the coin marketplace, and other important aspects of the hobby.

These individuals often go on to gain expertise in a particular niche or two, such as early U.S. gold coins or Seated Liberty coinage. This class of collector is poised to bring home coins that are properly graded and priced, with serious upside potential.

Let's now discuss this “Collect First, Invest Second” mentality...

Become a Collector First

What is a coin collector? Ask two or more people to answer that question, and chances are you'll get more than one answer.

Here is how the Free Dictionary defines the term:

Coin collector -- a collector and student of money (and coins in particular)

Unfortunately, they’ve gotten it wrong. Their definition is actually closer to that of a numismatist, but that’s off the mark, too, because its not broad enough. Lots of people misunderstand these terms, so no one should feel bad.

This is perhaps a more accurate description of a coin collector:

Coin Collector -- One who studies and collects coins as a hobby and with a purpose, rather than simply accumulating them.

And a more complete definition of a numismatist:

Numismatist -- A hobbyist who studies and collects money and medals, including coins, tokens, paper currency, and medals.

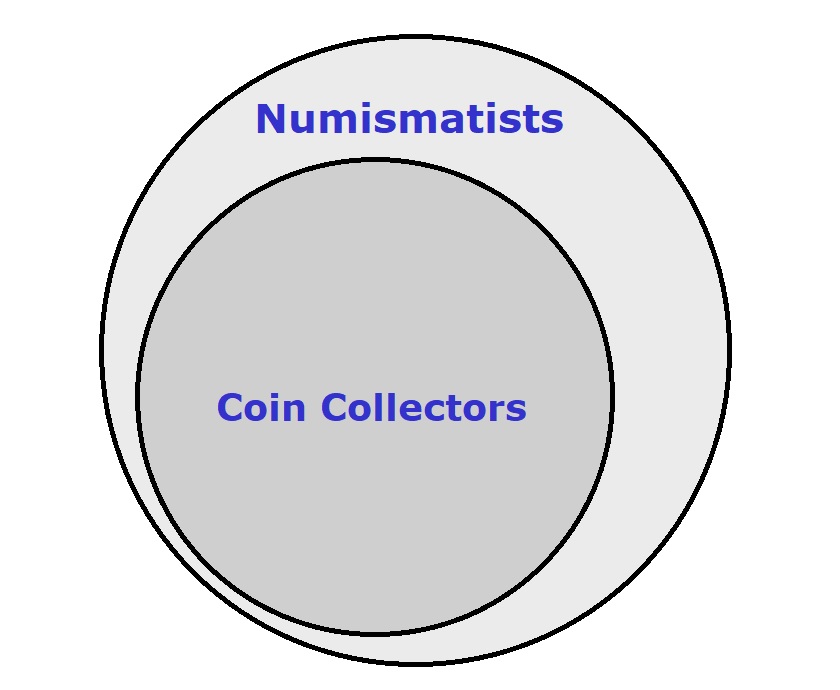

Technically, one group is a subset of another, giving rise to this Rare Coins 101 Axiom:

Not all numismatists are coin collectors, but all coin collectors are numismatists.

However, it's probably safe to say of the numismatist population, more of them are into coins than those who are not.

Now that we’ve eliminated any confusion on exactly what is a coin collector, how do you become one? It's not like studying quantum physics, but it does require time and effort.

There are many activities you can and should do to build the resumé of the consummate coin collector. What follows is only a brief summary of those activities, but don’t worry, they’re covered in much greater detail in the Getting Started in Coin Collecting section (there is a lot of ground to cover -- and it's important -- but we do not want to get sidetracked away from the subject of coin investing here in this section).

- Coin Grading: Learning how circulated, mint state, and proof coins are graded is essential for the aspiring coin collector. You don't need to ascend to the level of coin grading pro to be a high-performing collector, but the more you learn about it, the better.

- Absorb Knowledge & Stay Current: Aside from grading, there are many other hobby basics to absorb. Instead of counting sheep at night, you'll be mulling over coin types, key dates, die varieties, metal alloys, historic minting facilities, price guides, and more. You'll need to study the past, stay current on the present, and watch for future trends.

- What to Collect?: Setting goals is what defines you as a coin collector, not a mere accumulator of coins.

- Understanding Quality: Everyone talks about quality in coin collecting, but what exactly does that mean? The subject of quality is actually multi-dimensional. That is, there are different types of quality to consider when talking about coins.

- Develop a Passion: Those who fail to connect emotionally with their coins will probably never go far as a collector.

- Get to Know People: Thanks to technology, it’s possible to build a wonderfully satisfying collection without leaving the house, but getting acquainted with other dedicated collectors and professionals can certainly enhance your satisfaction with the hobby.

- Handling & Storing Coin Collections: Not understanding these fundamentals can result in damage to your coins.

- Coin Lingo: Coin collecting has a unique set of terms and slang expressions. Collectors must become at least semi-fluent in this language to advance beyond rookie status.

- Best Places to Buy Coins: Unless you've inherited a collection or somehow stumbled onto a coin trove, you'll probably have to buy coins from somewhere in the course of your collecting endeavors. It's crucial to your fulfillment to understand the where, who, and how of coin buying.

Everything discussed so far in this chapter can be succinctly captured in this Rare Coins 101 Axiom:

If you are buying coins with the intent of reaping economic rewards, your chances of success are enhanced by first buying into the role of dedicated coin collector.

As a reminder, you can get much more in-depth information over at the Rare Coins 101 Getting Started in Coin Collecting section. The overriding point to be made here is that it is important to become a proficient collector before attempting to move on to investor status.

A Hypothetical Scenario

Here’s a hypothetical scenario where the philosophy of “Collect First, Invest Second” pays off…

An experienced collector with an eye toward solid future price increases is presented with an opportunity to choose between A) a key date Morgan silver dollar in F-12 condition graded by PCGS and B) an equally priced generic Morgan in MS-65, as labeled by a relatively unknown grading service.

Right up front, the collector is confident the key date was properly graded by PCGS. What’s more, his homework revealed the coin has a long record of strong price advances because of bona fide numismatic demand and recognizes that as a harbinger of good news to come.

In considering the generic Morgan, a red flag is quickly detected. In its short existence, the grading service rating it as an MS-65 has already developed a reputation for overgrading. It’s possible (likely?) the outfit was formed to promote sales for certain mass merchandisers. That’s not all… through diligent research, the collector has discovered the coin has a mediocre price performance history to boot, regardless of grade.

Wisely, he chooses the F-12 key date as a proud addition to his collection.

Had he been an uninformed purchaser, he could have easily gotten hoodwinked into making the wrong choice.

See how that works?

A Real-Life Example: D. Brent Pogue

There are countless examples of individuals who embraced the “Collect First, Invest Second” philosophy. One of the most famous was D. Brent Pogue.

When Brent was 10 years old in 1974, his father Mack, a Dallas real estate developer, presented him with a large bag of wheat-back Lincoln cents. Armed with a copy of the Red Book, Brent eagerly scoured the hoard right down to the last penny. The glittering jewel of the stockpile was a like-new 1915 cent. In his memoirs, Brent reminisced “My first thought, since there was no mintmark, was ‘How did this penny make it from Philadelphia to Dallas? Then I asked myself ‘who was the president of the United States in 1915? What else was happening that year?’. From that moment onward, he was captivated.

Hungry for more, Brent befriended a kindly coin shop owner in north Dallas from whom he learned much. “He was always so kind to me,” Brent said, though “I was hardly his biggest client.”

Blessed with an innate sense of scholarly inquisitiveness, Brent formed a personal numismatic library, where he spent much of his time carefully formulating a coin collecting game plan. He attended coin shows and conventions and followed all the big auctions, soaking in every scrap of knowledge possible.

His dad, Mack, took notice of Brent’s numismatic prowess and agreed to finance his son’s enlightened passion. Together, over a period of many years, they built one of the very finest collections of all time, with emphasis on American coinage from 1792 to the 1830s. Every coin was meticulously selected by Brent because of compelling numismatic consequence.

The Pogue Family Collection was sold by Stack’s Bowers Galleries from May 2015 through March 2020 for nearly $133 million. Coins ranged in value from a few hundred to $5 million dollars. Not bad for a kid who started out with a bag of wheat pennies!(2)

Sadly, Brent passed away in 2019 at the age of 54.

Very few of us could match the scope of the Pogue collection, but Bent’s example of “Collect First, Invest Second” is a lesson everyone can follow. It served Brent well on a large scale, but is applicable no matter where you are on the coin investing spectrum.

Quick Links to Other Coin Investing Chapters...

The next chapter in this section is Coin Investing in 2024.

Use the links directly below to navigate the "Rare Coins as an Investment?" section:

- An Astounding Comparison

- Collect First, Invest Second (the current chapter)

- Coin Investing in 2024

- Ready to Invest? Test Your Coin IQ First

All the chapters referenced above are accessible from any other chapter in this section. Thus, no need to return to this Introductory page to link to other chapters.

Sources

1. Gilkes, Paul: Finest N-5 1825 cent acquired unattributed from eBay. Coin World, February 11, 2022.

2. Bowers, Q. David: Remembering D. Brent Pogue. Stacks Bowers Galleries, August 2, 2019.