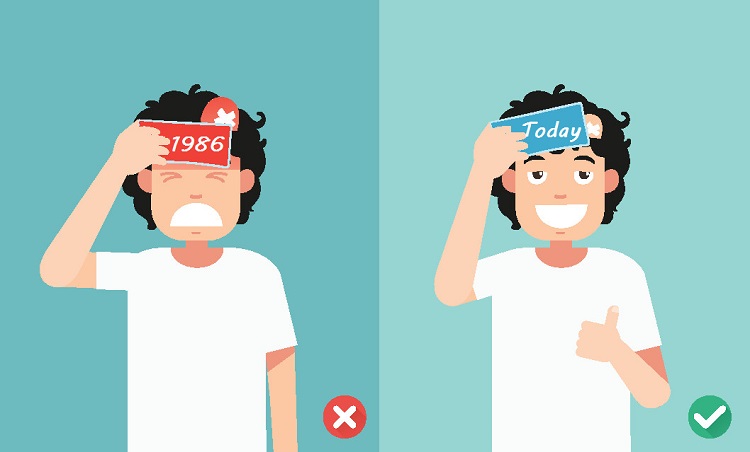

The Coin Grader Progression: From Boogeyman to Super Hero

Once upon a time, the coin grader role was seen by many as the Boogeyman of numismatics, because he was widely viewed with suspicion (often for good reason).

With the advent of certified coins and coin grading companies, the portrayal of the coin grader has progressed in a positive direction and he is now a Super Hero to many hobbyists and other coin buyers.

It took a long time to get to this point. As a rare coin enthusiast, it’s good background information to understand how we got to where we are today in the realm of coin grading. Let’s take a little jaunt into the past…

The Boogeyman is Coming

Grading has forever been central to numismatics, but for more than a century after United States coin collecting came of age in the 1850s to 1870s, the standards employed to grade coins were somewhat vague and applied inconsistently.

That’s because the science of grading coins is not the same as the science of physics or mathematics, where a formula yields an answer “c”, given inputs “a” and “b”. In reality, coin grading is more art than science.

Thus, assigning a grade to a coin was entirely subjective and opinions varied from one individual to the next. Moreover, this opened the door for unscrupulous behavior. Because a coin’s grade is frequently critical in determining its value, this naturally generated conflict between buyer and seller.

The finger-pointing all too often cast the coin grader persona as the villainous Boogeyman of the business and fostered an environment of distrust in wide circles. This toxicity was all too prevalent in the 1970s and 1980s.

Roguish individuals exploiting the coin grading murkiness deserved the rebuke, but even the honest coin grader rendering an unpopular opinion was labeled the Boogeyman as well. Not a good setting for coin collecting to flourish and grow.

As we are about to see, it was the vagueness called "Adjectival Grading" that set the stage for controversy.

Adjectival Grading

Going back to the 1950s and long before that, coin grading was limited to a few adjectival terms, such as Good, Fine, Very Fine, Uncirculated, and Proof, but without any widely agreed upon standard descriptions.

Accordingly, numismatic references of those times conformed to the same set of adjectives when reporting approximate retail coin values. Additional terms eventually worked their way into the numismatic lexicon, such as About Good, Extremely Fine, or About Uncirculated to describe “in-between” states of preservation.

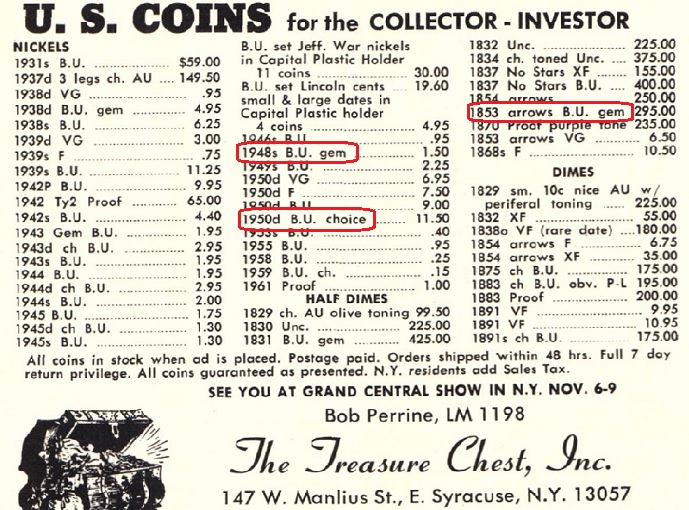

Advertisements for selling coins were similarly structured. Directly below is an ad from 1950. Coin collectors today would probably scoff if such an ad like this were to appear:

Varying distinctions of Uncirculated and Proof were recognized in many advertisements and auction bills by invoking modifying descriptors such as "Gem Brilliant Uncirculated" or "Choice Proof", as this ad from 1975 demonstrates:

With no clear point of reference or uniformity on how the modifying descriptors were invoked, most value guide publishers resorted to listing values for only one "Uncirculated" grade and one "Proof" grade.

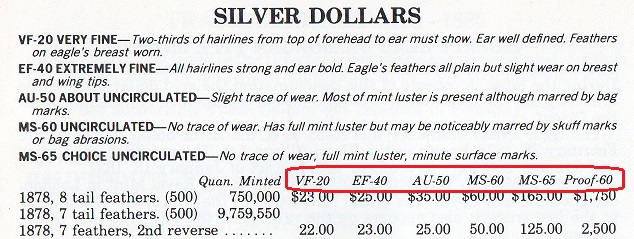

Below is a screenshot from the 1966 Redbook, to further illustrate the ambiguity that existed in coin grading from long ago. The Redbook from 1976 read almost the same verbatim.

The ANA 70-Point Scale is Introduced

In the mid-to-late 1970s, as coin prices escalated dramatically (much due to shady promoters), most notably for pristine, high quality specimens, incremental qualities of "Uncirculated" and "Proof" became evermore critical. Counterfeiting was also a growing concern.

In an effort to introduce greater standardization and consistency to coin grading, the American Numismatic Association in 1977 published the ANA Official Grading Standards for United States Coins.

The ANA proposed a 70-point grading continuum, based on a numeric system introduced by Dr. William Sheldon in 1949. Coins showing circulation wear would be assigned a grade from 1 to 59. Uncirculated coins (i.e., Mint State -- abbreviated as MS) were differentiated as MS-60 (no wear, but having many blemishes), MS-65 (fewer blemishes), or MS-70 (essentially no blemishes).(1)

Proof coins displaying no wear were similarly assigned grades PR-60 to PR-70.

Although not applied evenly from one dealer to the next (a situation that continued to hurt the coin business image), the practice of assigning an ANA numerical grade to indicate quality was nearly universal by the mid-1980s, and eventually set up the framework for coin grading that was absent as the hobby passed through its earlier decades.

This screenshot from the 1981 Redbook demonstrates usage of the ANA numerical grades:

A “Speedbump” in the Road

As the 1980s rolled on, MS-60 and MS-65 were the grades most often listed in publications to represent coins on the Mint State side of the ANA scale. As coin values continued rising and grading became even more critical, other “in-between” grades such as MS-63 began appearing with greater frequency.(2)

Unfortunately, the grading standards established by the ANA in 1977 were somewhat vague, leading to varying interpretations. Problems emerged when one person’s MS-63 was judged to be an MS-65 by others, setting up a speedbump on the road to greater consistency in coin grading.

In response to marketplace demand for tighter standards, the ANA modified its grading interpretations in February 1986 accordingly.

This meant that coins, even if fairly and correctly graded as MS-65 prior to 1986, might have to have their grades revised downward to MS-63 (or less), to be consistent with the newly revised interpretations.

Conversely, a coin graded after 1986 as MS-63 was about equal in quality to an MS-65 coin graded before 1986. Naturally, this ignited a firestorm of controversy.

The Emergence of Third-Party Grading Services

Thankfully, something else happened in February 1986 to maintain momentum in the quest to establish reliable grading practices throughout the coin industry...

On February 3, 1986, a watershed event occurred in the world of coin collecting. On that day, the Professional Coin Grading Service (PCGS) began providing a third-party expert appraisal of a coin's physical condition and corresponding numerical grade on the 70-point scale.

Their service also included authentication (to combat counterfeiting), labeling and encapsulation in a tamper-evident, protective coin holder. After encapsulation, the coin was deemed a "certified" coin. In numismatic lingo, a certified coin is often called a "slab" because the plastic holder is mostly a flat chunk of material resembling a slab.

To bolster its reputation, the PCGS submittal network consisted of established coin dealers around the nation and offered a money back guarantee.

For readers a little fuzzy on how PCGS functioned as a “third party”, it means they did not buy or sell coins, they simply graded them independently and without regard for who the owner or potential buyer was. The fee for their service was paid by the coin submitter. In other words, the message was PCGS was unbiased and didn’t “have a dog in the hunt”.

(For those unfamiliar with this idiom, if someone has a “dog in the hunt”, it means they have a special interest or stake in or something to gain by a given situation.)

The following year, 1987, the Numismatic Guaranty Corporation (NGC) was born and operated in much the same way (they are now known as the Numismatic Guaranty Company).

Here’s Where We are in 2024

The third-party grading approach transformed the rare coin industry in a positive way. Not coincidentally, as grading standards improved in consistency and widespread use, the coin marketplace was increasingly characterized by:

- Strong collector demand and greater stability.

- Trust and sight unseen buying.

- Easier coin liquidity.

- True rarity transparency.

- Worldwide interest in U.S. coins.

- Steady to higher prices.

In short, coin collectors felt more secure and confident when buying coins under the PCGS and NGC labels. This was a major step in the evolution of coin grading.

In 2024, both PCGS and NGC are by far acknowledged as the mainstays of third-party coin grading. However, very recently, the Certified Acceptance Corporation began a grading service as well. This is a development worth keeping an eye on.

At various places throughout Rare Coins 101, I’ve lauded the efforts of PCGS and NGC. No, I am not on their payroll. I mention them favorably because as a life-long collector I appreciate their contribution to numismatics and what they’ve done to ensure the current and future viability of the hobby so many of us love.

As was introduced in this section, coin grading is an inexact science and is not subject to the predictable laws of nature. Anytime human opinion is involved, there will be disagreement.

It's always possible to find imperfection and inconsistencies with their services, but the chronic grading fiascos of the past are gone and things are much better. These coin graders are Super Heroes in my estimation. Thank you PCGS and NGC!

Quick Links to Other Coin Grading Chapters...

The next chapter in this section is Grading Circulated Coins.

Use the links directly below to navigate the "What is Coin Grading?" section:

- The Coin Grader Progression: From Boogeyman to Super Hero (the current chapter)

- Grading Circulated Coins

- Mint State Coins

- Proof Coins

- Stars, "Green Beans", and "Plus" Grading

- Grades as Reported on Rare Coins 101

- Suggested Coin Grading References

All the chapters referenced above are accessible from any other chapter this section. Thus, no need to return to this Introductory page to link to other chapters.

Sources

1. Bressett, Kenneth, and Bowers, Q. David. The Official American Numismatic Association Grading Standards for United States Coins, 7th ed. Pelham, AL. Whitman Publishing, 2019.

2. Bressett and Bowers. The Official American Numismatic Association Grading Standards for United States Coins, 7th ed.

As an Amazon Affiliate I earn from qualifying purchases, at no added cost to you. Thank you!